Part 1 of this two-part series discussed emerging trends and inflection points reshaping the semiconductor manufacturing industry. The slowdown in the pace of Moore’s Law scaling, the rising importance of the system-on-chip and the rapid growth of the mobile market all favor an open, plug-and-play foundry and design ecosystem. Expect the ecosystem developing around ARM to continue to nip at Intel’s core markets as development of ARM-based processors for laptops and servers accelerates. This emerging threat to Intel, and Intel’s response to it, will define the industry over the coming decade.

Intel in an open ecosystem

The operating system war between Microsoft and Apple in the 1980s came to define the PC and software industries. Microsoft’s open-ecosystem model won; Windows became the de facto PC OS. Ironically, even as Microsoft promoted an open ecosystem in the larger PC industry, it spawned a closed ecosystem in the chip industry. The Wintel alliance ensured that Windows ran only on the x86 architecture, which was pioneered and owned by Intel (Advanced Micro Devices also used the x86 but never matched Intel’s scale or manufacturing expertise).

A hallmark of the post-PC era is the emergence of an open ecosystem within the semiconductor industry. Unlike the Wintel dominance of the past, the post-PC era is being defined by competing OS options (iOS, Android or Windows 8) and competing processor architectures (x86 or ARM). Today, the momentum is in favor of ARM-based operating systems; iOS, Android and Windows 8 all will run on ARM, while only Android and Windows 8 will be x86-compatible.

The chip wars will be fought in this fragmented and open ecosystem on three fronts: SoC/system integration, CPU/processor architecture and silicon/foundry technology. The choice of transistor architecture will strongly influence the outcome in each sphere. And while performance and power will continue to be important benchmarks, the open ecosystem supporting a worldwide consumer market will make cost a key success metric on each front.

SoC/system integration

In the mobile SoC market, the battle for processor architecture will be between Intel on the one hand and the incumbents, such as Qualcomm, Samsung and TI, on the other.

In the mobile, power-constrained space, it is more efficient to integrate a variety of hardware accelerators on a single chip, in order to deliver custom functionality, than it is to implement a general-purpose core serving most functions.

Low-power cores are supplemented with elements as disparate as an on-chip radio, GPS, modem, image and audio/video processors, connectivity and a graphics processor. Figure in previous part illustrates the difference between a traditional CPU and an integrated SoC. An open ecosystem is more cost-effective for such modular, plug-and-play systemlevel integration.

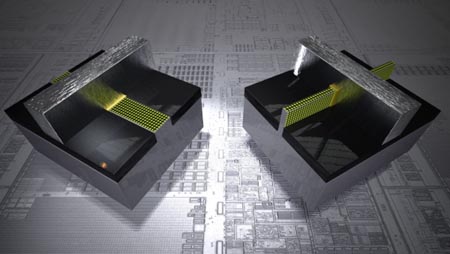

Historically, Intel, as an integrated device manufacturer, has independently designed most of the functional IP blocks, while ensuring that each uses Intel transistor technology and process design rules. Intel’s move to tri-gate transistor architecture will benefit it enormously in the CPU segment, giving its designers access to best-in-class transistor performance.

|

|

|

Nonplanar trigate transistor model |

Intel’s ability to compete in the mobile SoC market will be determined by how well it can reengineer the tri-gate transistor to meet the diverse needs of a complex mobile SoC. If Intel can successfully design and manufacture tri-gate transistors that span the full range of the performance/power spectrum, it will have a huge edge over the competition.

But Intel will also need to offer a cost advantage. Average selling price in the SoC space is a fraction of that in the CPU market. The compatibility of tri-gate in analog and RF applications remains unknown and may necessitate a more costly system-in-package (SiP) solution, as opposed to the cheaper and more desirable SoC solution. And while fabless Qualcomm, for example, can drive the best possible deal from foundries, IDM Intel’s ASPs must be high enough to let it recoup its own development and manufacturing capex.

Intel may try to enhance its functionality offerings via more acquisitions along the lines of its purchase of Infineon Wireless. Post-merger, however, porting Infineon’s foundry standard design rules to Intel’s proprietary design rules is no trivial task. By contrast, the Qualcomm acquisition of Atheros proved to be more seamless, since the intellectual property was from the open ecosystem and as already foundry compatible.

For Intel, the low-cost, mobile SoC is a “segment zero phenomenon” that could become a strategic inflection point, much as the budget-PC category was in the late 1990s.

CPU/core architecture

The main battle on the CPU front is between the x86 and ARM architectures. While Intel historically has had the upper hand in performance, ARM-designed cores have delivered superior performance/watt.

To compete effectively against ARM, Intel will need to design its low-power Atom cores in the most power-efficient way possible. To design a truly low-power core, Intel may need to decouple the Atom from legacy x86-based architecture and develop a ground-up design that delivers highly competitive performance/ watt. Intel will also have to be in aggressive catch-up mode as it tries to reverse the momentum of an already large, established and robust ARM software ecosystem.

|

|

|

Intel Atom two-core processor |

In the initial years of the PC era, as the x86 became the predominant CPU architecture, an entire ecosystem of application software was created around it. That effectively precluded or seriously hindered competing architectures, such as the Power- PC, from gaining a foothold in the marketplace.

Today, ARM architecture is significantly further along in achieving critical mass in mobile SoCs. The prevalence of ARM in a range of post-PC devices, ranging from smartphones and tablets to televisions and cars, inhibits the newer Atom architecture from achieving traction. From a practical standpoint, if Intel hopes to gain a meaningful share in the mobile market, it has to ensure compatibility with the ARM software ecosystem.

That will force Intel to compete on price, which will limit how much revenue it can eventually generate. Intel has not had to face a similar dynamic in the PC segment.

Silicon/foundry technology

Intel’s ability to make the best-performing transistor at the highest possible yields and volumes is unparalleled. That capability served it immensely well in the closed ecosystem, as Intel essentially competed against itself in the quest to make a better transistor. In the closed ecosystem, performance trumped power and design flexibility, and high ASPs ensured that development cost was not a significant limiter.

In the open ecosystem, however, the ability to integrate disparate functional accelerators in the most power-efficient and cost-effective manner is paramount.

Samsung, for example, can make the highly successful and functional A5 processor for Apple using a trailing-edge 45-nm transistor process and integrate all the complex IP blocks from a variety of vendors while keeping the ASP under $20. Samsung’s minimum metal pitch at the 45-nm node is comparable to that of Intel at the more-advanced 32-nm node, yet the cost of a 32- or 28-nm wafer is much higher than that of a 45-nm wafer. Even with a trailing edge transistor, Samsung can offer best-in-class area density and best-in-class power efficiency at an acceptable performance point.

|

|

|

A5 Processor, developed by Samsung for Apple |

Further, companies such as Apple or Qualcomm usually prefer to design around a standard process that enables design portability between foundries to mitigate supply issues while containing costs. Radical deviations from foundry standard processing will only serve to increase the adoption barrier in an open silicon ecosystem. If tri-gate becomes a challenge for foundries to adopt quickly (owing to its sheer cost and complexity, and the innovation needed to accommodate it), it may further strengthen the manufacturing and design ecosystem around a planar architecture.

Based on the points discussed thus far in Parts 1 and 2, these trends are likely to define the semiconductor industry over the next decade:

- The 28-nm node will have at least a five-year life cycle. Foundries will innovate to enhance power/performance/cost and extend the life of the 28-nm transistor. Polysilicon gate technology is likely to enjoy a renaissance at the 28-nm node as it offers the lowest-cost and lowest-risk option for mobile products and platforms that do not require the highest performance.

- A longer 28-nm life cycle will provide more time to develop a 20-nm technology that will also benefit from enhancements at the 28-nm node. The 20-nm node will see universal adoption of the metal gate-last scheme, which in turn may promote design portability and potentially level the playing field among the foundries. The 20-nm node will also see a long life cycle (at least five years) given the unclear patterning road map to the 14-nm node.

- Intel will extend its tri-gate leadership beyond the 22-nm node and will continue to dominate the CPU/server segment (single thread/high performance), albeit with increasing competition from the ARM ecosystem. The next five years will see the emergence of ARM-based servers; Hewlett-Packard/ Calxeda, Nvidia, Applied Micro and Marvell have all announced plans to introduce ARM-based server products. Using an open ecosystem with customizable IP will enable significant cost and power reduction for these new entrants.

- Not being part of an open ecosystem may hinder Intel’s efforts to gain mobile market share at the system level. Recent announcements indicate that after decades of blindly following Intel, former archrival AMD is retooling with an emphasis on the SoC to enable a plug-and-play approach for mobile. AMD plans to continue using x86-based architecture but is also open to licensing ARM cores if needed. That indicates AMD is responding to the shifting landscape.

- In a power- and cost-competitive environment, on-chip integration of hardware accelerators (modem, CPU, graphics, etc.) will prove to be extremely efficient. Compared with centralized CPU/GPU cores, SoCs will be far more effective, especially in the tablet and Ultrabook form factors.

- The headlining SoC duel in the coming year will be between Intel’s 22-nm tri-gate mobile SoC (Silvermont, rolling in 2013) and Qualcomm/TSMC’s 28-nm planar mobile SoC (the Snapdragon S4, 2012). This will provide a direct matchup between the planar/trailing transistor and the nonplanar/leading transistor.

- A move to the 450-mm wafer size has the potential to disrupt the industry cost model. A glut of fully depreciated 300-mm fab infrastructure and lingering uncertainty in the extreme-UV lithography tooling road map will make it a difficult value proposition for the foreseeable future.